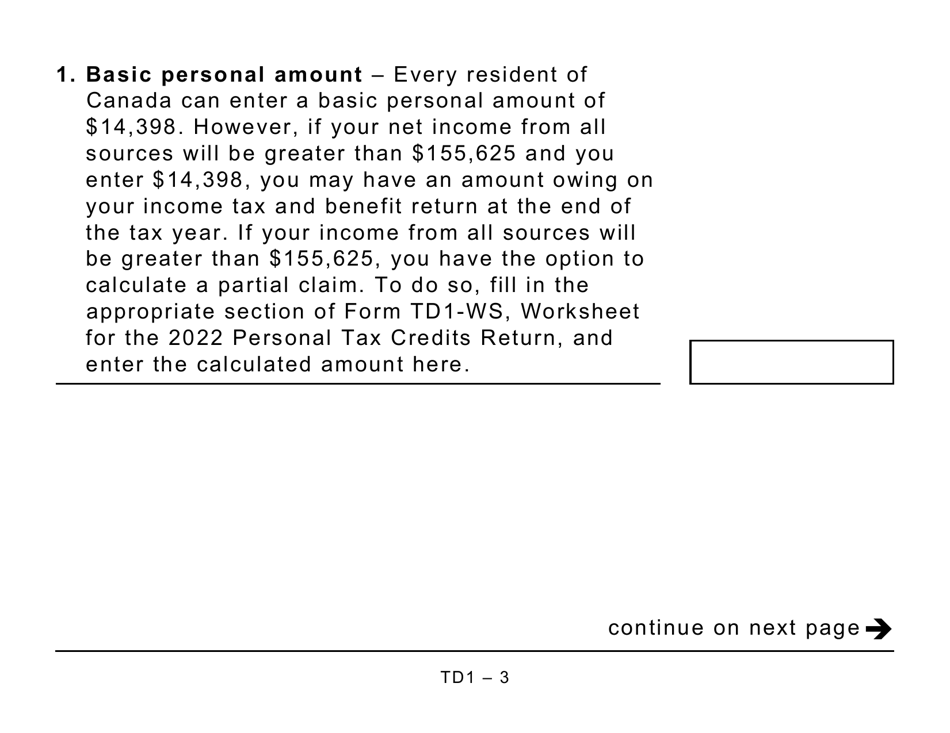

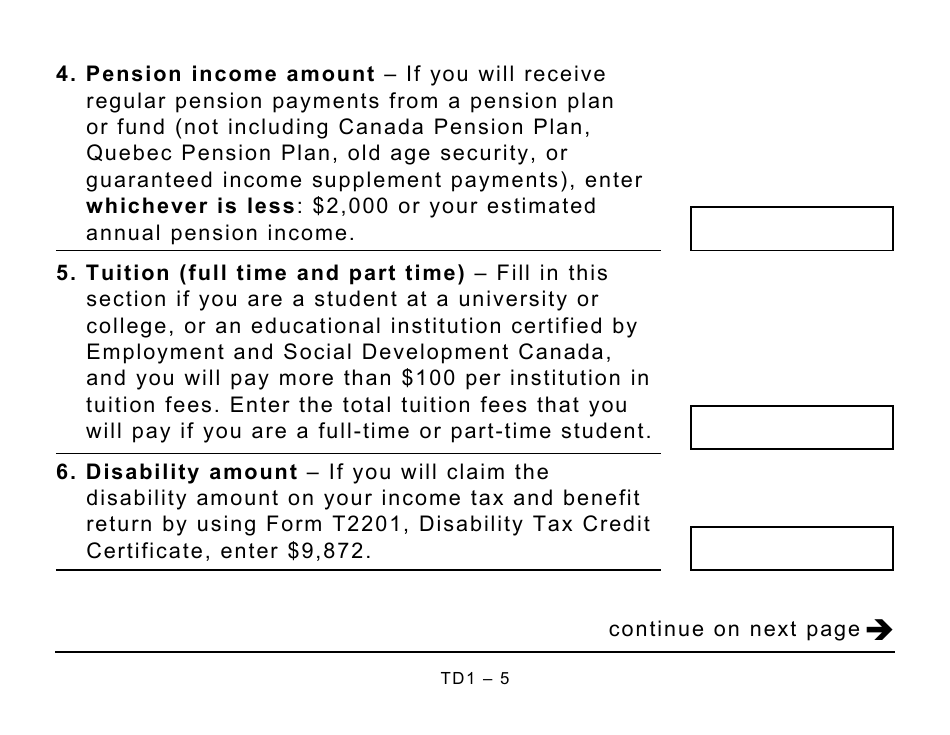

2025 Personal Tax Credits Return Form. Fill out this form based on the best estimate of your circumstances. My total claim amount was only line 1, i.e.

My total claim amount was only line 1, i.e. Employer/ payer uses the td1 personal tax credit return to determine the amount of income taxes to be deducted from employment income or other income.

Cra 2025 Personal Tax Credits Return Form Mella Siobhan, Read page 2 before filling out this form.

2025 Personal Tax Credits Return Form Td1 Peri Trista, The td1 form, also known as a personal tax credits return form, helps new employers to accurately source deductions and calculate how much tax they should deduct from an employee’s income.

2025 Personal Tax Credits Return Form Nb Sybil Euphemia, Simply put, a td1, personal tax credits return, is a form that is necessary for calculating how much tax should be withheld from payments.

2025 Personal Tax Credits Return Form Kerry Melonie, You are required to do a federal and a provincial td1 form.

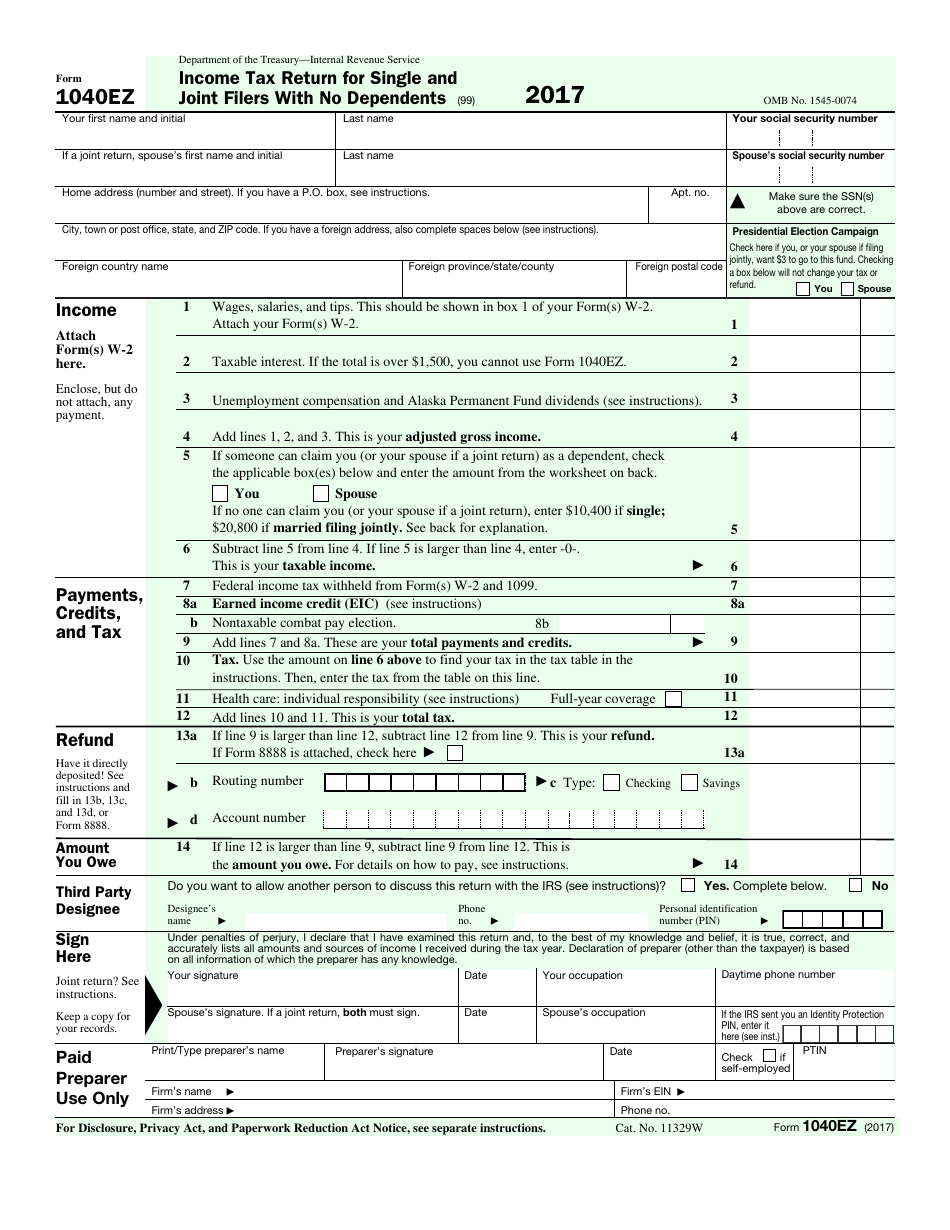

Here’s when you can begin filing federal tax returns, and why the IRS says it may be frustrating, Simply put, a td1, personal tax credits return, is a form that is necessary for calculating how much tax should be withheld from payments.

2025 Ontario Personal Tax Credits Return Form Esther Fanechka, The basic personal tax credit is different for each province and different than the federal amount.

2025 Personal Tax Credits Return Form Td1 Peri Trista, Your employer or payer will use this form to determine the amount of your tax deductions.

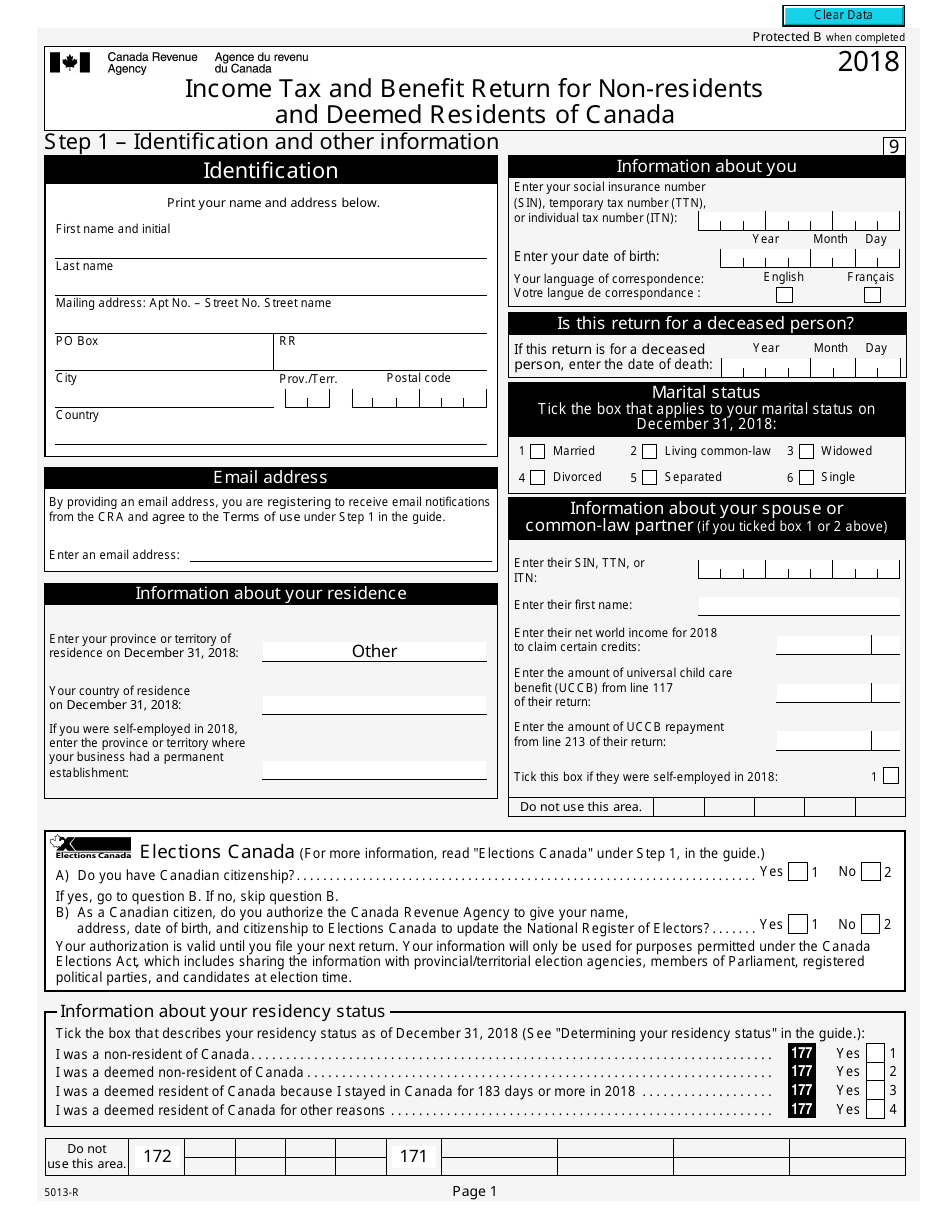

2025 Personal Tax Credits Return Bc Davita Giacinta, Td1, personal tax credits return, is a form used to determine the amount of tax to be deducted from an individual's employment income or other income, such as pension income.

2025 Personal Tax Credits Return Form 2025 Kylen Deerdre, Access to canada revenue agency (cra) forms, tax packages, guides, publications, reports, and technical notices.